Please download and run the installer from https://caplab.b-cdn.net/Capitalism_Lab_Installer.exe

Please note that save games older than v9.1.00 are not compatible with this new version.

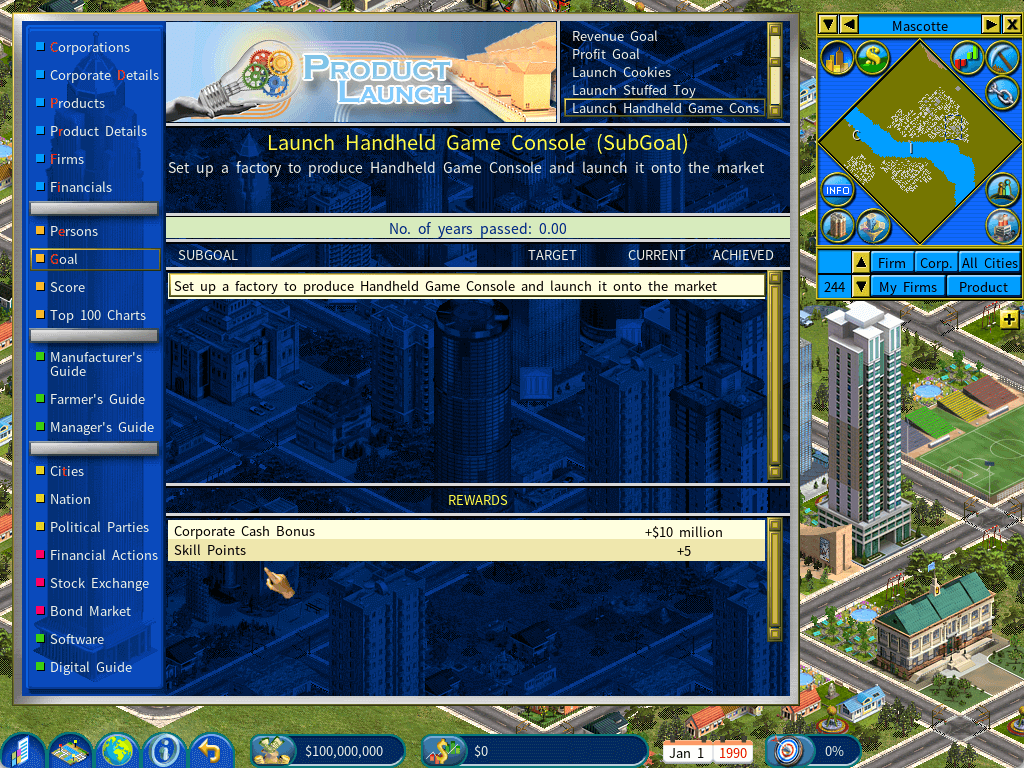

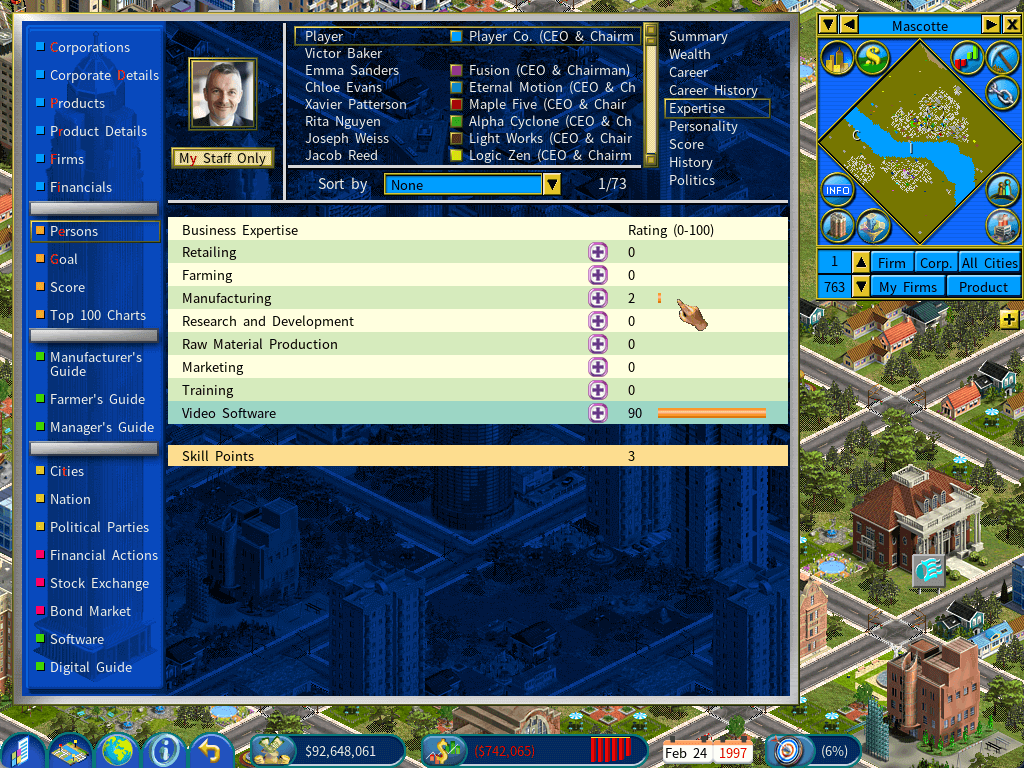

New Feature: Skill Points

We're excited to announce a new way to customize and empower your character in Capitalism Lab - skill points! Now certain goals will offer skill points as rewards when completed.

You can use skill points to increase your player character’s expertise across key business areas like retail, manufacturing, marketing, and R&D. Boost your talents to get an edge over the competition.

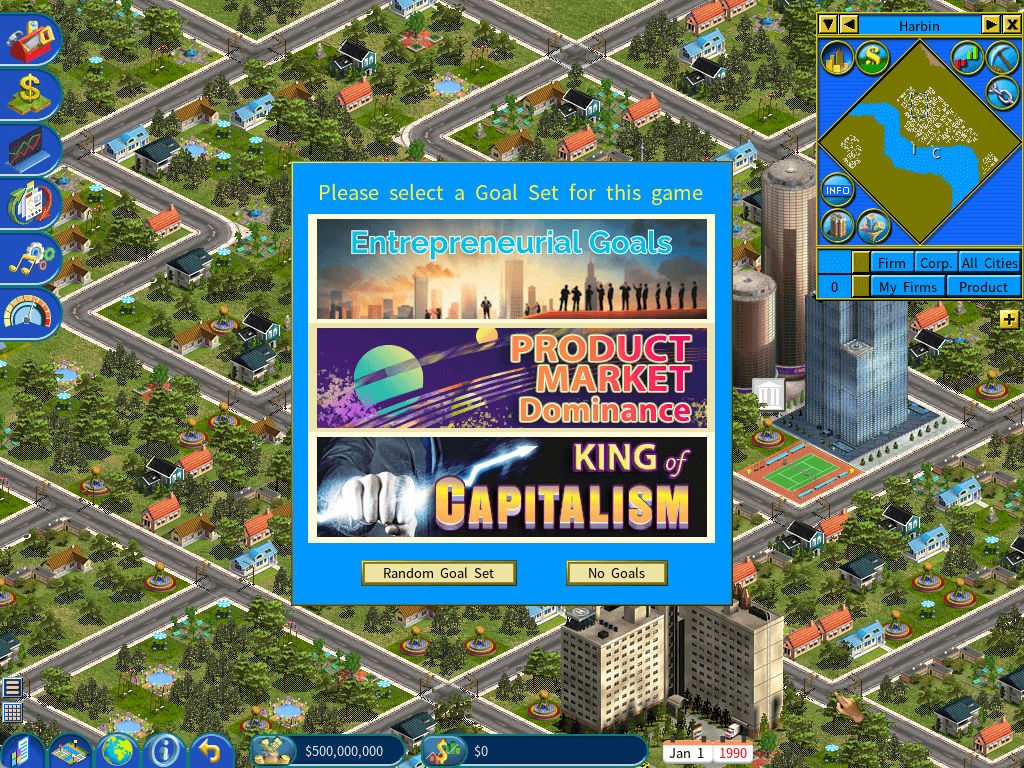

New Goal Set – Entrepreneur Goals

You can now also select the new "Entrepreneur Goals" set when starting a custom game, giving you fresh objective options as you build your business empire.

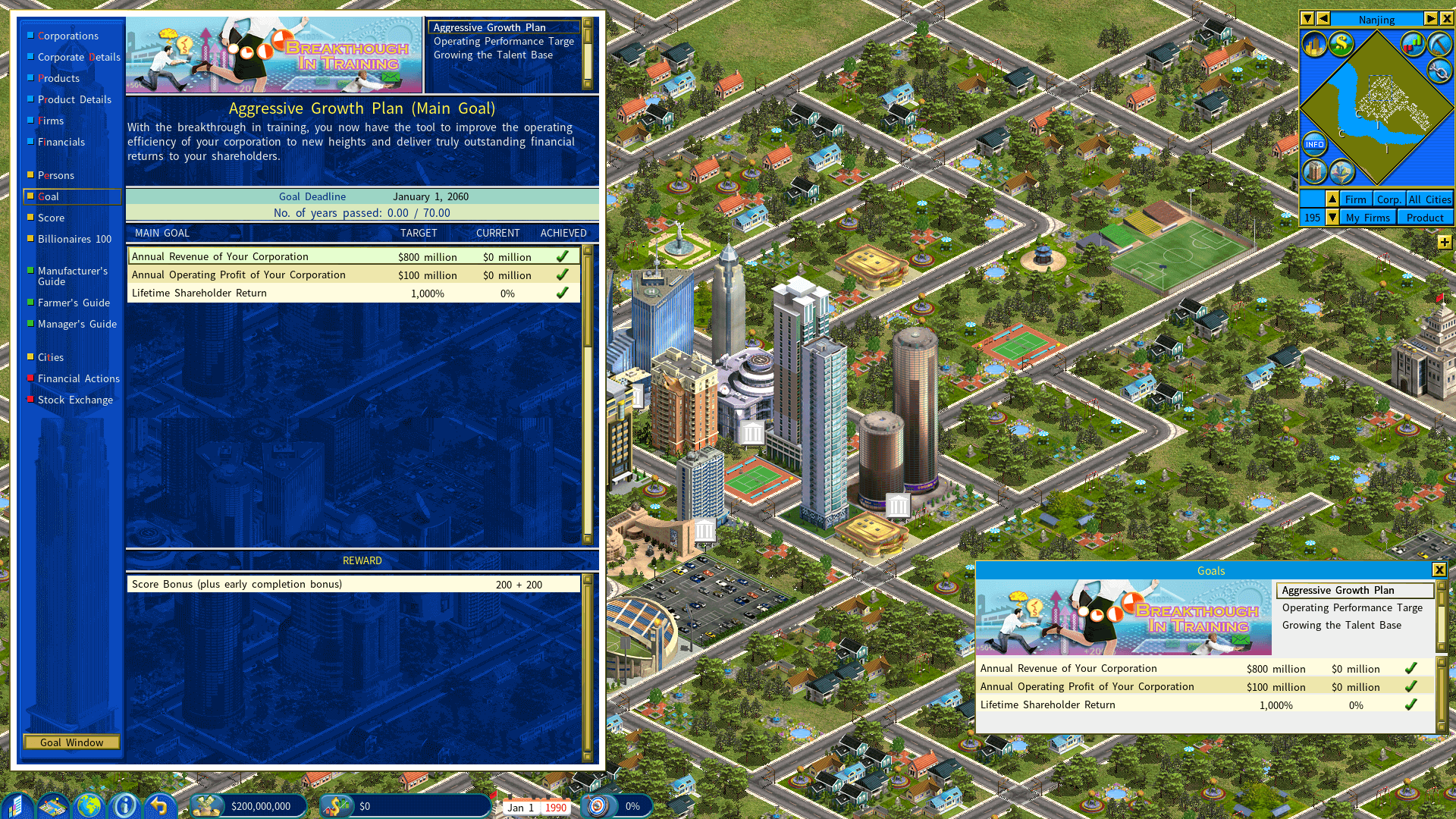

Movable Goal Window

This version introduces an all-new goal window in Capitalism Lab. This handy window allows you to easily track your goals without opening the Information Center. To open the goal window, simply click the Goal icon on the bottom menu bar.

It will automatically hide when the Information Center or the Firm Detail window are open, so your view remains uncluttered.

The goal window is partially movable – you can drag it around your screen as needed, as long as it doesn't overlap the other key windows.

Multiple Auto Saves (A New Script Command)

Use this new script command to auto-save games at a specific interval.

Until other auto-save features, it will not overwrite old autosave files. Instead, it writes to a new file each time, so you don't have to worry about losing older saves either. You'll have a complete history of save points going back as far as you want. It's perfect for easily jumping back in time to re-explore alternate strategies at key decision points.

Script Syntax:

[SPECIAL RULES]

Multiple Auto Saves Interval Years=<number of years>

Example:

[SPECIAL RULES]

Multiple Auto Saves Interval Years=10

The game will auto-save games every 10 years and each game file will have a unique name.

For example: APLA_001.SAV for year 2000, APLA_002.SAV for year 2010, and so forth.

<number of years> can have decimal places.

For example:

Multiple Auto Saves Interval Years=1.5

It will auto save games every 1.5 years.

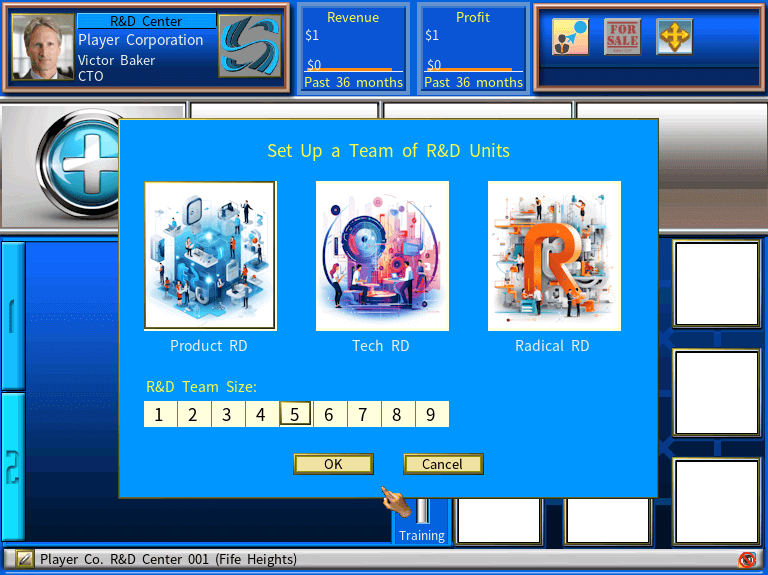

A New Tool for Automatically Setting up R&D Units

This new time-saving tool automatically sets up R&D units in your R&D centers - no more tedious manual setup of individual R&D units.

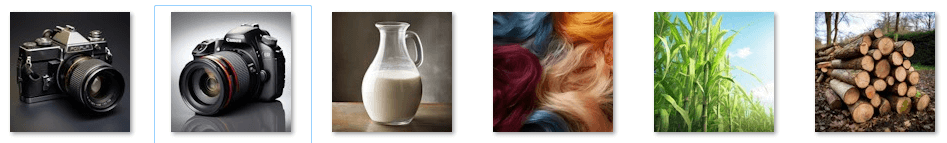

New Product Images

New product images including Milk, Polyester, Sugarcane, Camera, Digital Camera, Timber

New Random Event Images

New images for the random events: Riot and Insect Plague.

New Music Tracks

This version comes with 20 brand new music tracks! These fresh tunes replace the old Capitalism 2 music to completely revamp your tycoon experience. As you build your corporate empire, you'll now be accompanied by these lively, motivational beats.

Speech for News and Events

This version improves the gaming experience by adding speech for certain news and events.

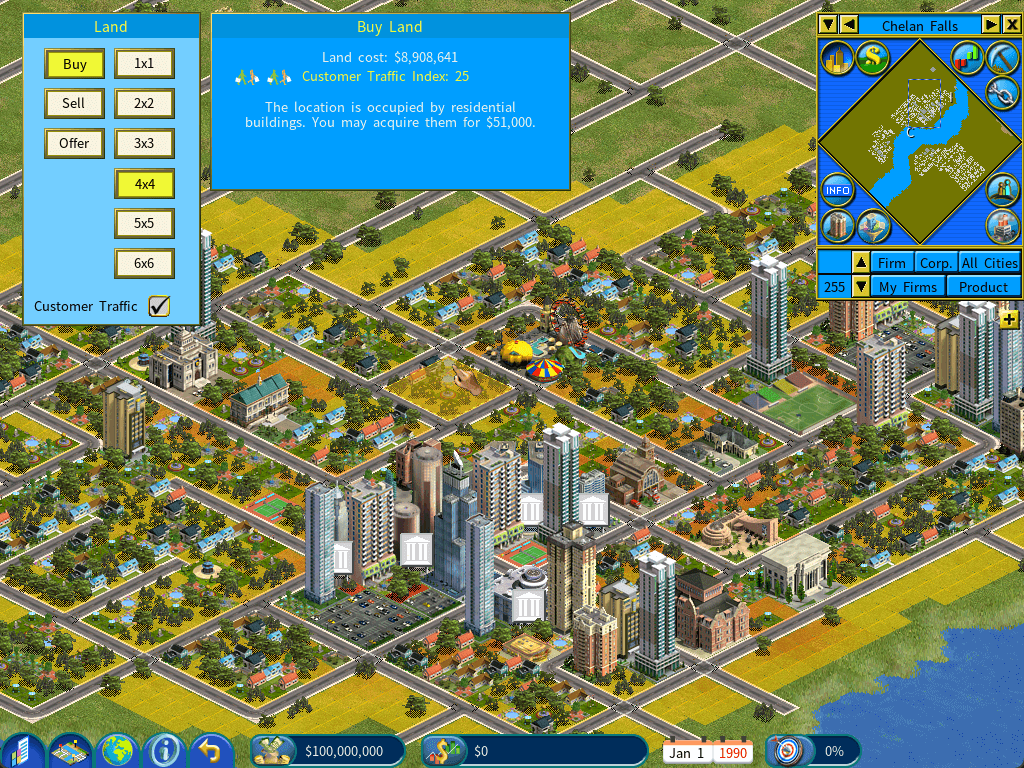

Showing Customer Traffic Overlay When Buying Land Plots

Choosing the ideal location just got easier with our new Customer Traffic Overlay. Now when choosing land plots to purchase, you can enable an overlay showing customer traffic flows on the city map. The traffic overlay visually highlights high and low traffic areas in different colors, giving you valuable insight for expanding your businesses.

AI Improvement

AI will build farm extensions if the feature is enabled.

Interface Improvements

1) The news window will be displayed on the right side of the screen if the screen is wide enough, thus avoiding blocking the view of the firm detail window or the first information center window.

2) The news display options window has now two checkboxes, make it more visually apparent about the availability of the options.

3) Added a new Market Cap sorting option to the Corporation List.

Mayor Can Now Move Mansions

When you are the mayor of a city, you will be able to move mansions to other locations in the city.

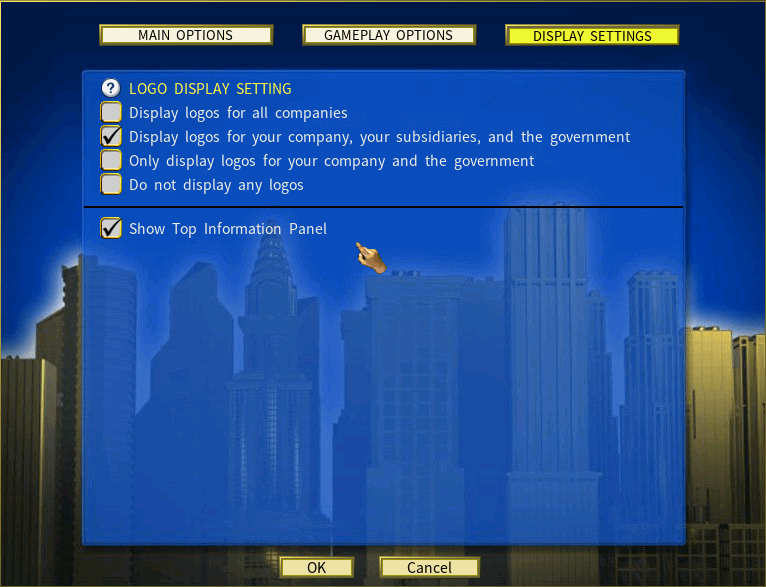

New Options in the Options Menu

1) Added new options for displaying logos on the city map, which are available under the new [Display Settings] category. You can select from the following modes for displaying logos:

a) Display logos for all firms

b) Only display logos for your firms

c) Display logos for your firms and your subsidiaries (this is the default setting)

d) Do not display any logos.

You can also use the shortcut key Ctrl-O to change this setting during the game without accessing the Options menu.

2) Added a new toggle for displaying Show Top Information Panel (hotkey: CTRL-P)

When this option is enabled, an information panel will be displayed at the top of the screen during a game with Realistic Money Supply or Survival mode enabled. When this is disabled, the info panel will not be displayed.

3) Added an option to auto-approve salary raises, under the [Gameplay Options] category

When enabled, requests for salary raises from your executives will be automatically approved without showing a dialog box. This will be useful when you want to let the game run without any user interactions for a certain period of time.

Banking and Finance DLC Improvements

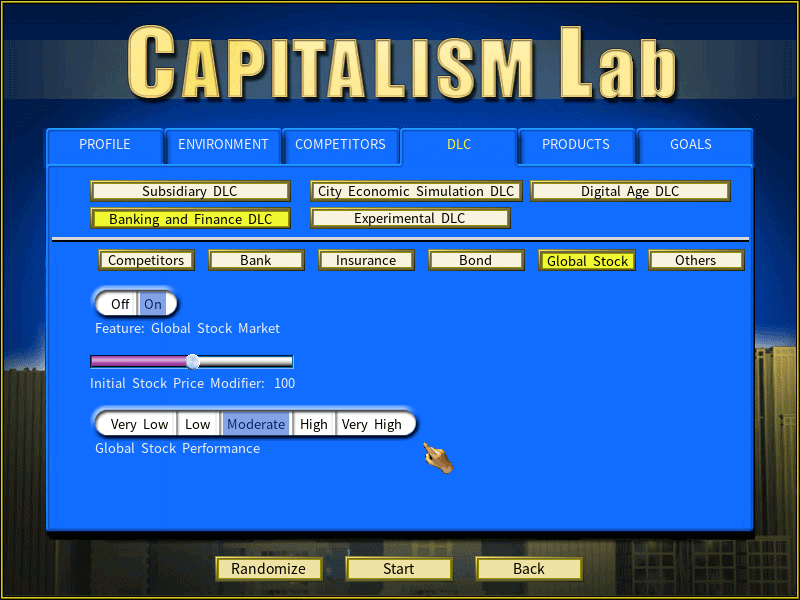

New Customization Option for Global Stocks

Added an option for setting the long-term performance of global stocks.

Since the majority of an insurance company’s incomes are from investment gains in global stocks, the presence of this option allows the user to tailor the profitability of insurance companies.

We have also improved the simulation model - global stock returns will decrease over time, especially when a company’s market cap has grown to a very large size, to reflect the fact that it is increasingly difficult to make profits as markets become saturated.

Realistic Loan Demand for Banks

If this option is enabled, the demand for bank loans is realistically based on the total GDP of the cities. If this is disabled, the loan demand will be substantially higher but still have a limit. (In the previous versions, there is no limit if this option is disabled.)

This adjustment improves gameplay balance because consistently high loan demand can lead to excessively huge bank profits after the game has been running for a very long time.

Note to translators about the help text change

The help text in HELP.TXT for:

GOALACHI

Goal Achievement Progress

It indicates your progress in achieving the goals. Click here to open the #Goal report#. (hotkey: G)

has been changed to:

Goal Achievement Progress

It indicates your progress in achieving the goals. Click here to open the #Goal window#.